At MyCouponCodes, we value companies that combine reliability with real savings, and that’s why we love Blue Insurance . As a trusted provider in the insurance industry, Blue Insurance stands out for its commitment to customer care, transparent policies, and innovative coverage solutions for individuals, families, and businesses alike. What truly sets them apart is their wide range of saving opportunities throughout the year. From seasonal promotions and festive discounts to loyalty rewards and online-exclusive deals, Blue Insurance consistently finds ways to help customers get more value for less. Their refer-a-friend program and bundle options also offer smart, cost-effective solutions without compromising on protection. Whether it’s during a holiday campaign or a new product launch, Blue Insurance HK ensures that saving is simple, accessible, and rewarding. That dedication to affordability and quality is exactly why MyCouponCodes proudly recommends them to our savvy, deal-hunting community.

HK$800 supermarket e-Voucher

Details > Apply WeMedi HK Dental Protector D2 to get HK$800 supermarket e-Voucher VALID FOR ALL THE CURRENT YEAR

Apply WeMedi HK Dental Protector D2 to get HK$800 supermarket e-Voucher VALID FOR ALL THE CURRENT YEAR

BEST Blue Insurance Promo Code 2025 - First Year Free

Details > Get First year premium as low as HK$0 after Blue Insurance discount VALID FOR ALL THE CURRENT YEAR

Get First year premium as low as HK$0 after Blue Insurance discount VALID FOR ALL THE CURRENT YEAR

HK$200 Blue Insurance Coupon Code

Details > Get HK$200 Off or applying a minimum HK$1m sum assured plan VALID FOR ALL THE CURRENT YEAR

Get HK$200 Off or applying a minimum HK$1m sum assured plan VALID FOR ALL THE CURRENT YEAR

HK$200 e-Voucher - Blue Insurance Promo Code

Details > Get HK$200 e-Voucher by applying a minimum HK$1m sum assured plan with Blue Insurance Promo Code. VALID FOR ALL THE CURRENT YEAR

Get HK$200 e-Voucher by applying a minimum HK$1m sum assured plan with Blue Insurance Promo Code. VALID FOR ALL THE CURRENT YEAR

50% Blue Insurance Promo Code

Details > 50% off 1st year premium + HK$1,000 supermarket e-Voucher for applying a minimum HK$2m sum assured plan VALID FOR ALL THE CURRENT YEAR

50% off 1st year premium + HK$1,000 supermarket e-Voucher for applying a minimum HK$2m sum assured plan VALID FOR ALL THE CURRENT YEAR

50% Blue Insurance Promo Code April 2025

Details > Get 50% off for First-Year Premium + HK$500 supermarket e-Voucher VALID FOR ALL THE CURRENT YEAR

Get 50% off for First-Year Premium + HK$500 supermarket e-Voucher VALID FOR ALL THE CURRENT YEAR

Blue Insurance Promo Code - 🦷 Dental Fee Waiver Service: Coverage Up to HKD$17,000 + Rewards

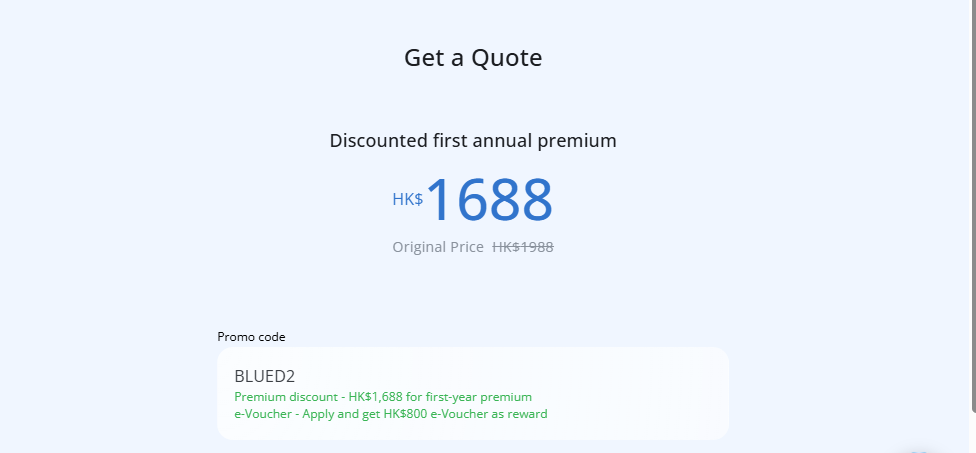

Details > Get comprehensive dental fee coverage up to HKD$17,000! Use this Blue Insurance Promo Code to enjoy your first-year premium for just HKD$1,688 and receive an HKD$800 supermarket coupon. Expires: 2030-12-31

Get comprehensive dental fee coverage up to HKD$17,000! Use this Blue Insurance Promo Code to enjoy your first-year premium for just HKD$1,688 and receive an HKD$800 supermarket coupon. Expires: 2030-12-31

Blue Insurance Promo Code - 109% rebate on critical illness insurance

Details > Apply for WeCare 109% rebate on critical illness insurance and save up ti 91% Off with this Blue Insurance 優惠券 VALID FOR ALL THE CURRENT YEAR

Apply for WeCare 109% rebate on critical illness insurance and save up ti 91% Off with this Blue Insurance 優惠券 VALID FOR ALL THE CURRENT YEAR

Discover all the Best Blue Insurance Promo Codes 2025 - 80% Off

Details > Click to Apply to the best Blue Insurance promotion codes in April 2025. Get a Discount up to 80% Of VALID FOR ALL THE CURRENT YEAR

Click to Apply to the best Blue Insurance promotion codes in April 2025. Get a Discount up to 80% Of VALID FOR ALL THE CURRENT YEAR

Blue Insurance Promo Code - Cancer protection as low as HK$0,5/day

Details > VALID FOR ALL THE CURRENT YEAR

VALID FOR ALL THE CURRENT YEAR

55% Blue Insurance Promo Code

Details > Applyfor WeCare Critical Illness Protection Plan 1 at 55% Off VALID FOR ALL THE CURRENT YEAR

Applyfor WeCare Critical Illness Protection Plan 1 at 55% Off VALID FOR ALL THE CURRENT YEAR

Blue Insurance HK Promo Code 50% Off

Details > Get 50% Off WeCare Flexible Term Life Protection Plan TF1 with Blue Insurance Promo Code 2025. VALID FOR ALL THE CURRENT YEAR

Get 50% Off WeCare Flexible Term Life Protection Plan TF1 with Blue Insurance Promo Code 2025. VALID FOR ALL THE CURRENT YEAR

🛡️ Blue Insurance Promo Codes, Coupons & Deals | April 2025

Details > Protect what matters with Blue Insurance. Use our coupons for savings on insurance plans. VALID FOR ALL THE CURRENT YEAR

Protect what matters with Blue Insurance. Use our coupons for savings on insurance plans. VALID FOR ALL THE CURRENT YEAR

Accidental Hospitalization Cash Insurance up to HK$1,500 per day

Details > Get up to HK$1500 per day when you apply for this Blue Insurance HK Promo Code VALID FOR ALL THE CURRENT YEAR

Get up to HK$1500 per day when you apply for this Blue Insurance HK Promo Code VALID FOR ALL THE CURRENT YEAR

Free protection for your children up to HK$300,000 without any Blue Insurance促銷代碼

Details > Apply for WeCare Critical Illness Protection Plan1 and get free protection for your children up to HK$300,000. No need any Blue Insurance促銷代碼 VALID FOR ALL THE CURRENT YEAR

Apply for WeCare Critical Illness Protection Plan1 and get free protection for your children up to HK$300,000. No need any Blue Insurance促銷代碼 VALID FOR ALL THE CURRENT YEAR

WeGuard Pharmacy EASY Guarantee HK$1.15/ month instead HK$44

Details > Enjoy peace of mind with WeGuard Pharmacy's EASY Guarantee. Now at an unbeatable price of just HK$1.15/month instead of HK$44. VALID FOR ALL THE CURRENT YEAR

Enjoy peace of mind with WeGuard Pharmacy's EASY Guarantee. Now at an unbeatable price of just HK$1.15/month instead of HK$44. VALID FOR ALL THE CURRENT YEAR

Personal Accident Protection Plan1 only HK$4.17

Details > Apply for WeCare Personal Accident Protection Plan1 only HK$4.17 per month VALID FOR ALL THE CURRENT YEAR

Apply for WeCare Personal Accident Protection Plan1 only HK$4.17 per month VALID FOR ALL THE CURRENT YEAR

Guaranteed average annual dividend payout rate of 2.7% at Blue Insurance Hong Kong

Details > VALID FOR ALL THE CURRENT YEAR

VALID FOR ALL THE CURRENT YEAR

NEVER MISS A PROMO CODE!

YOU WILL FIND EVERY VALID PROMO CODES AND DISCOUNTS

Blue Insurance Discount Codes You Just Missed

How to Use Blue Insurance Promo Code

Applying a Blue Insurance promo code HK is a straightforward process that allows you to enjoy discounts or special offers on insurance policies. Here's a step-by-step guide on how to apply a Blue Insurance promo code:

-

Find a Blue Insurance Coupon Code: Start by searching for a valid Blue Insurance coupon code. You can often find these codes on the Blue Insurance website, in promotional emails, or on authorized coupon websites. Make sure the coupon code is still valid and applies to the insurance policy you want to purchase.

-

Select Your Insurance Policy: Visit the Blue Insurance website and browse the available insurance policies. Choose the policy that best suits your needs and preferences.

-

Calculate Your Quote: Use the online quote calculator to get an estimate of the cost of your insurance policy. This will give you an idea of the regular price before applying the coupon code.

-

Proceed to Checkout: After selecting your policy and receiving your quote, click the "Get a Quote" or "Buy Now" button to initiate the checkout process.

-

Enter Your Coupon Code: During the checkout process, you will typically find a field labeled "Coupon Code," "Promo Code," or something similar. This is where you'll enter the Blue Insurance coupon code you found earlier. Type or paste the code into the designated field.

-

Apply the Coupon Code: After entering the coupon code, click on the "Apply" or "Submit" button next to the coupon code field. The system will validate the code, and if it's valid, you'll see the discount or special offer applied to your insurance policy's price.

-

Review Your Discount: Double-check the cost of your insurance policy to ensure that the coupon code has successfully applied the discount. You should see the reduced price after the coupon code has been applied.

-

Continue the Checkout Process: If you're satisfied with the discount applied, proceed with the checkout process. You will need to provide your personal and payment information to finalize the purchase of your insurance policy.

-

Complete Your Purchase: After reviewing all the details and confirming that the coupon code has reduced the price as expected, finalize your purchase by clicking the "Complete Purchase" or similar button. You'll receive a confirmation of your discounted insurance policy.

It's important to note that Blue Insurance coupon codes may have specific terms and conditions, such as expiration dates, restrictions on the type of policies they apply to, or minimum purchase requirements. Make sure to review these terms and ensure that your coupon code is still valid. By following these steps, you can successfully apply a Blue Insurance coupon code and enjoy savings on your insurance policy.

Enjoy Remearkable Discounts with Blue Insurance Promo Code

Insurance Plans and Packages at Blue Insurance

Blue Insurance is a leading provider of a wide range of insurance plans and packages designed to offer comprehensive coverage for individuals, families, and businesses. Whether you're looking to protect your car, home, health, or travel, Blue Insurance has a variety of plans to suit your specific needs. In addition to their diverse offerings, Blue Insurance also provides opportunities to save through the use of discount codes, such as the Blue Insurance Promo Code, Blue Insurance Promo Code HK, Blue Insurance HK Promo Code, Blue Digital Insurance promo code, and Blue Digital Insurance promo code Hong Kong.

Insurance Plans and Packages:

-

Car Insurance: Blue Insurance offers a variety of car insurance plans, including comprehensive coverage, third-party liability, and more. You can tailor your policy to fit your specific needs, whether you're a new driver, a seasoned motorist, or insuring multiple vehicles.

-

Home Insurance: Protecting your home is a top priority, and Blue Insurance understands this. Their home insurance plans cover the building itself, the contents inside, or a combination of both. This ensures that your property is safeguarded against unexpected events.

-

Travel Insurance: Whether you're traveling for business or leisure, Blue Insurance's travel insurance plans provide peace of mind. These policies include medical coverage, trip cancellation protection, and a range of assistance services to support you during your journey.

-

Health Insurance: Your health is priceless, and Blue Insurance offers health insurance plans, including private medical insurance, to ensure you receive the best medical care when needed. These plans offer coverage for medical expenses and hospitalization, providing financial security in times of illness or injury.

-

Gadget Insurance: In our digital age, gadgets and electronics have become essential. Blue Insurance's gadget insurance plans cover accidental damage, theft, and loss of devices like smartphones, tablets, and laptops, helping you protect your valuable tech investments.

-

Pet Insurance: Your pets are part of your family, and Blue Insurance's pet insurance plans cover veterinary bills, ensuring that your furry companions receive the care and attention they deserve. These plans offer peace of mind for pet owners.

- Blue Digital Insurance Promo Code: Blue Digital Insurance, a subsidiary of Blue Insurance, may offer its own promo codes. Keep an eye out for these codes to secure savings on digital insurance products.

Why Mycouponcodes Loves Blue Insurance

Cancellation and Refund at Blue Insurance

Blue Insurance understands that your circumstances may change, and you might need to cancel your policy. To begin the cancellation process, contact Blue Insurance via their website, email, or phone with your policy details. It’s important to review your policy’s terms, as cancellation fees or conditions may apply. You may be asked to provide a reason for cancellation, and the effective date will be confirmed with you. If eligible, a refund will be processed—typically via your original payment method—based on the remaining coverage period and any applicable fees. After cancellation, Blue Insurance will issue confirmation documents for your records. Be sure to check for any outstanding payments that could affect your refund. Keep in mind that coverage ends once the policy is canceled, so arrange alternative protection if needed. For exact details, always refer to your policy documents or contact Blue Insurance’s customer service for assistance.

Customer Service

For inquiries, support, or assistance, you can reach Blue Insurance Hong Kong through the following channels:

Customer Service Hotline:

📞 +852 3106 3000

🕒 Service Hours: Monday to Friday, 9:00 AM – 5:30 PM

Email Support:

📧 support@blueinsurance.hk

Live Chat:

💬 Available on the Blue Insurance Hong Kong website for real-time assistance during business hours.

Social Media & Online Support:

🌐 Website: www.blueinsurance.hk

📱 Facebook: @BlueInsuranceHK

📱 Instagram: @blueinsurancehk

For quick answers to common questions, visit the FAQs & Help Center section on the Blue Insurance Hong Kong website.

Blue Insurance Frequently Asked question (FAQs)

What is a Blue Insurance Promo Code?

A Blue Insurance Promo Code is a special alphanumeric code that offers discounts or promotions on insurance policies from Blue Insurance specifically for customers in Hong Kong. By entering this code during the purchase process, you can enjoy savings on your insurance premiums.

Where can I find Blue Insurance Promo Code?

You can typically find Blue Insurance Promo Code on the official Blue Insurance website, in promotional emails, or on authorized coupon websites. It's important to ensure that the code you find is valid and applicable to the insurance policy you wish to purchase.

How do I use a Blue Insurance Promo Code?

Using a Blue Insurance Promo Code is straightforward. When purchasing your insurance policy on the Blue Insurance website, there is usually a designated field labeled "Promo Code" or "Discount Code." Enter the code in this field, click "Apply," and the discount will be reflected in your policy's price.

Are there any restrictions on Blue Insurance Promo Code?

Yes, Blue Insurance Promo Code HK may have restrictions. Common restrictions include expiration dates, minimum purchase requirements, and limitations on specific types of insurance policies. Always review the terms and conditions associated with each promo code to ensure it's applicable to your policy.

Can I use a Blue Insurance Promo Code on any policy?

The applicability of a Blue Insurance Promo Code HK may vary depending on the code and the type of insurance policy. Some codes are specific to certain insurance categories, while others may be more versatile. It's essential to check if the code is valid for the policy you intend to purchase.